Getting familiar with Medicare Advantage Plans

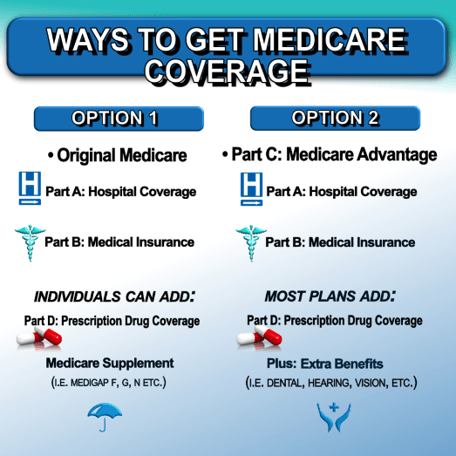

Medicare Advantage Plans represent made available by private Insurance providers that contract with Medicare to provide Part A plus Part B protection in a single combined format. In contrast to traditional Medicare, Medicare Advantage Plans commonly include supplemental services such as drug coverage, oral health care, eye care services, & wellness programs. Such Medicare Advantage Plans operate within established coverage regions, which makes location a critical element during review.

Ways Medicare Advantage Plans Compare From Traditional Medicare

Original Medicare allows broad doctor choice, while Medicare Advantage Plans typically operate through managed networks like HMOs in addition to PPOs. Medicare Advantage Plans can require provider referrals in addition to in-network providers, but they commonly offset those constraints with predictable out-of-pocket amounts. For numerous individuals, Medicare Advantage Plans deliver a balance between budget awareness not to mention expanded coverage that Original Medicare independently does not typically deliver.

Who May want to Evaluate Medicare Advantage Plans

Medicare Advantage Plans are well suited for people looking for coordinated care & possible expense reductions under a single plan structure. Beneficiaries managing chronic conditions often prefer Medicare Advantage Plans because connected care models simplify treatment. Medicare Advantage Plans can also appeal to individuals who want packaged services without managing separate supplemental policies.

Eligibility Criteria for Medicare Advantage Plans

To qualify for Medicare Advantage Plans, participation in Medicare Part A along with Part B is required. Medicare Advantage Plans are open to most people aged 65 and/or older, as well as younger people with eligible disabilities. Enrollment in Medicare Advantage Plans relies on living status within a plan’s coverage region and timing aligned with authorized registration timeframes.

When to Enroll in Medicare Advantage Plans

Proper timing plays a vital role when enrolling in Medicare Advantage Plans. The Initial Enrollment Period centers around your Medicare eligibility date along with permits first-time selection of Medicare Advantage Plans. Overlooking this period does not necessarily eliminate eligibility, but it often change available options for Medicare Advantage Plans later in the calendar cycle.

Annual not to mention Special Enrollment Periods

Each autumn, the Annual Enrollment Period permits enrollees to change, remove, and/or enroll in Medicare Advantage Plans. Special enrollment windows are triggered when qualifying events take place, such as moving even Policy National Medicare Advantage Plans loss of coverage, making it possible for changes to Medicare Advantage Plans beyond the normal timeline. Understanding these timeframes ensures Medicare Advantage Plans remain within reach when situations evolve.

How to Review Medicare Advantage Plans Effectively

Evaluating Medicare Advantage Plans requires focus to more than recurring costs alone. Medicare Advantage Plans change by network structures, out-of-pocket maximums, drug lists, along with coverage rules. A thorough review of Medicare Advantage Plans helps matching medical needs with plan designs.

Costs, Benefits, also Network Networks

Monthly expenses, copayments, and annual limits all influence the overall value of Medicare Advantage Plans. Some Medicare Advantage Plans offer minimal monthly costs but elevated out-of-pocket expenses, while alternative options focus on stable spending. Provider availability also changes, so making it essential to confirm that preferred providers accept the Medicare Advantage Plans under review.

Prescription Benefits as well as Extra Services

Many Medicare Advantage Plans include Part D drug coverage, simplifying medication management. Beyond medications, Medicare Advantage Plans may offer fitness programs, transportation services, as well as over-the-counter benefits. Evaluating these elements ensures Medicare Advantage Plans align with ongoing healthcare priorities.

Enrolling in Medicare Advantage Plans

Sign-up in Medicare Advantage Plans can happen digitally, by phone, or through licensed Insurance professionals. Medicare Advantage Plans require precise personal details with confirmation of qualification before activation. Submitting enrollment properly helps avoid processing delays and/or unexpected coverage gaps within Medicare Advantage Plans.

The Value of Licensed Insurance Agents

Licensed Insurance professionals help interpret coverage details also describe differences among Medicare Advantage Plans. Connecting with an expert can clarify network restrictions, coverage boundaries, also expenses tied to Medicare Advantage Plans. Expert assistance frequently streamlines decision-making during enrollment.

Frequent Mistakes to Watch for With Medicare Advantage Plans

Overlooking doctor networks ranks among the most errors when evaluating Medicare Advantage Plans. A separate problem involves focusing only on premiums without accounting for total expenses across Medicare Advantage Plans. Examining coverage materials carefully reduces misunderstandings after enrollment.

Reevaluating Medicare Advantage Plans Each Coverage Year

Healthcare needs shift, and Medicare Advantage Plans change each year as part of that process. Reassessing Medicare Advantage Plans during open enrollment permits changes when benefits, expenses, alternatively providers change. Consistent assessment keeps Medicare Advantage Plans aligned with existing medical priorities.

Reasons Medicare Advantage Plans Continue to Expand

Enrollment data show rising interest in Medicare Advantage Plans nationwide. Additional benefits, structured out-of-pocket caps, with coordinated care contribute to the appeal of Medicare Advantage Plans. As options increase, well-researched comparison becomes even more important.

Long-Term Benefits of Medicare Advantage Plans

For numerous individuals, Medicare Advantage Plans offer reliability through connected benefits along with structured care. Medicare Advantage Plans can reduce management burden while supporting preventive care. Identifying appropriate Medicare Advantage Plans builds confidence throughout later life stages.

Evaluate plus Enroll in Medicare Advantage Plans Now

Taking the right step with Medicare Advantage Plans begins by reviewing local options and also checking eligibility. If you are entering Medicare with reviewing current coverage, Medicare Advantage Plans present flexible solutions created to support different healthcare priorities. Compare Medicare Advantage Plans now to secure a plan that fits both your medical needs and your budget.